Maine’s new paid leave law is the result of years

of research and hard work - all to get it right.

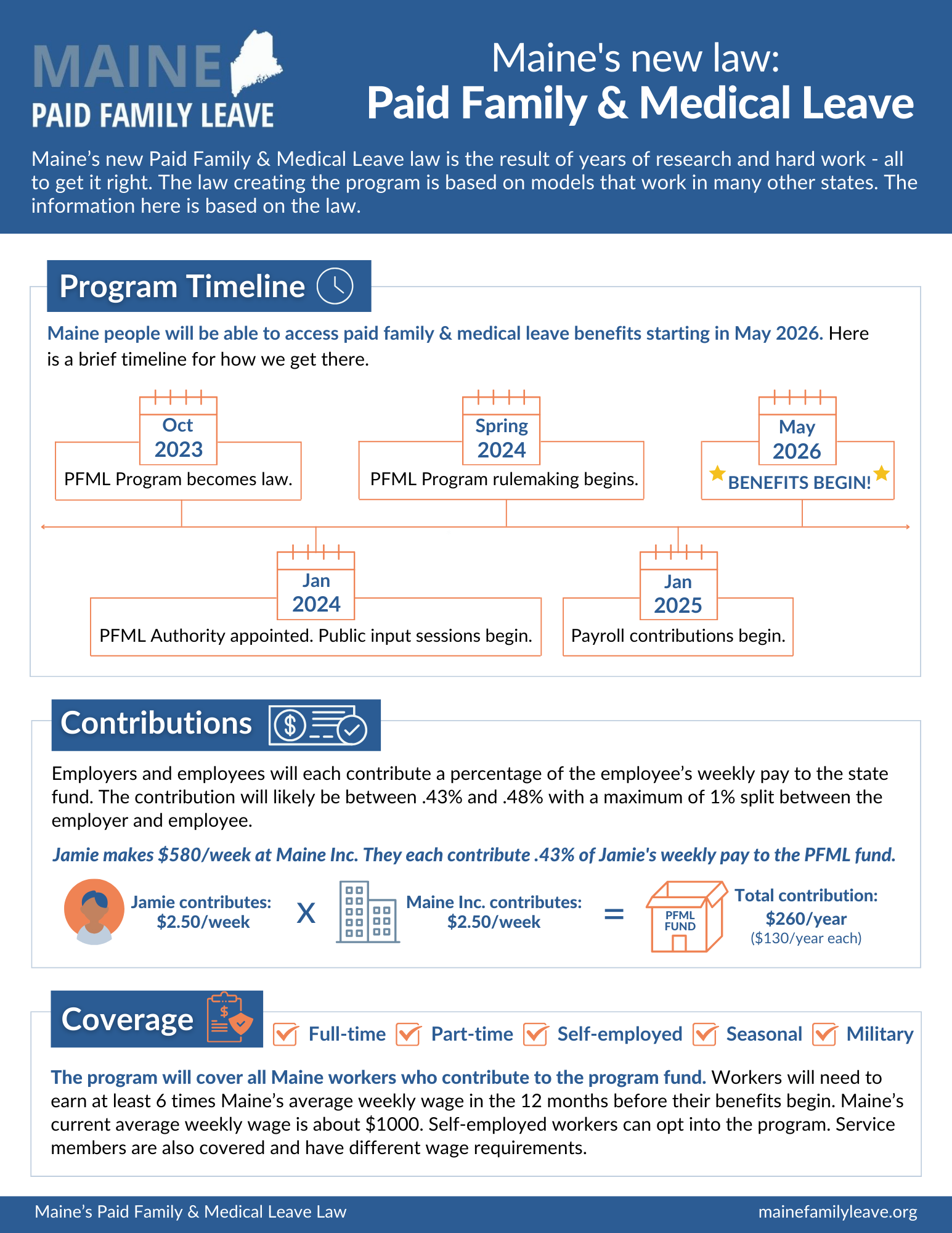

The new law establishing Maine’s Paid Family & Medical Leave Program is based on models that work in many other states.

Download a one-page document of this information & some examples by clicking on the image below!

-

The program will cover all Maine workers who contribute to the program fund. This includes full-time, part-time, seif-employed, and seasonal.

Workers will need to earn at least 6 times Maine's average weekly wage in the 12 months before their benefits begin. Maine’s current average weekly wage is about $1000.

Self-employed workers can opt into the program. Service members are also covered with different wage requirements.

-

Contributions are set to begin January 2025.

Employers and employees will each contribute a certain percentage of the employee’s weekly pay to the state fund. If you are a small business with less than 15 employees, you do not have to pay the employer contribution to the fund - and your staff can still be covered by the program if they meet other program requirements. Self-employed workers will only to pay the employee contribution. The contribution rate will likely be between .43% and .48% - with a maximum of 1% split between the employer and employee.

-

People can take leave for what the law calls qualified reasons. This includes to care for themselves or a family member with a serious health condition, to bond with a child after birth, adoption, or foster placement, and leave for victims of domestic violence, sexual violence, and stalking.

-

A person can take up to 12 weeks for a qualified reason in a benefit year. Paid leave will need to be taken at the same time as federal Family Medical Leave Act leave. The weekly benefit is determined by a person's income. It is capped at the state's average weekly wage, which is about $1,000 a week.

-

After 120 days of employment at a job, a person who takes leave is entitled to their job or an equivalent when they return to work.

-

Small businesses and self-employed workers do not contribute the employer portion to the fund. However, employees of the small business (and people who are self-employed) are still eligible to take leave if they meet other program requirements.

Paid Family & Medical Leave:

Program Timeline

OCT 2023

PFML Program officially

becomes law!

JAN 2024

PFML Authority appointed.

Public input sessions begin.

SPRING 2024

PFML Program rulemaking begins.

JAN 2025

Payroll contributions to the

PFML fund contributions begin.